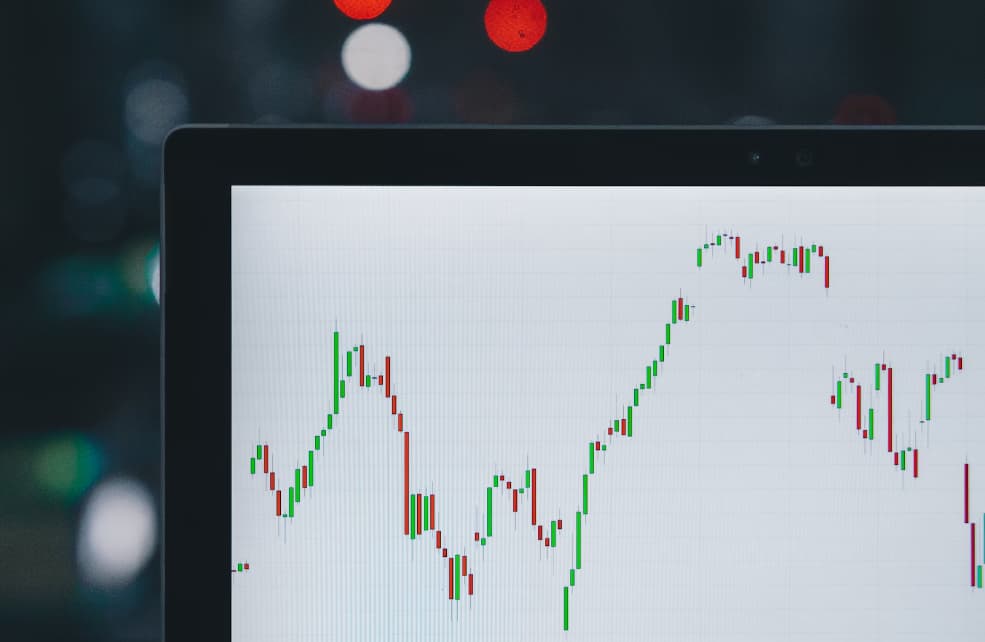

In the dynamic landscape of financial markets, futures trading has evolved into a sophisticated endeavor that demands innovative strategies to stay ahead of the curve.

For UK traders, navigating this terrain requires a keen understanding of market nuances and exploring less conventional tactics.

Futures Trading 2.0: Uncommon Strategies for UK Traders

This article delves into futures trading 2.0, unveiling uncommon strategies tailored for UK traders seeking to gain a competitive edge.

The Power of Macro Trends: Beyond Short-term Volatility

While short-term price fluctuations often dominate the trading discourse, advanced UK traders recognize the importance of macro trends that shape the broader market landscape.

Futures trading 2.0 involves delving into economic indicators, geopolitical shifts, and global macroeconomic trends that can have lasting impacts on asset prices. This long-term perspective enables traders to position themselves strategically and capitalize on more significant market movements.

Embracing contrarian thinking can yield substantial rewards. When most market participants align their views, unconventional strategies can provide a unique advantage.

UK traders who can identify opportunities where sentiment has deviated from underlying fundamentals can capitalize on market mispricings, creating a potential for significant gains.

Pairs trading: Navigating correlations with precision

In the pursuit of uncommon strategies, UK traders have turned to pairs trading to navigate complex market relationships. This strategy involves identifying correlated assets and taking advantage of temporary dislocations in their price movements.

Advanced traders recognize that while markets may be efficient in the long term, short-term discrepancies between correlated assets can offer lucrative opportunities.

Pairs trading involves going long on the underperforming asset while simultaneously going short on the outperforming one. This hedges against market risk, allowing traders to profit from the convergence of prices.

UK traders employing this strategy often focus on sectors within the same market or assets affected by similar economic factors.

Volatility Skew: Capitalising on Implied Volatility Variations

Trading thrives on volatility, and UK traders are now tapping into the potential of volatility skew as an advanced strategy. Volatility skew refers to the uneven distribution of implied volatility among options contracts at different strike prices.

Often, out-of-the-money options exhibit higher implied volatility compared to at-the-money options. Savvy UK traders understand this skew can offer valuable insights into market expectations and sentiment.

By analyzing volatility skew, traders can infer potential market moves. When the skew is particularly pronounced, it might indicate an upcoming event or news release that could significantly impact the asset’s price.

Traders can then adjust their positions accordingly, using options strategies that take advantage of the anticipated price movement. This strategy demands a deep understanding of options and their implied volatility dynamics, making it more suitable for experienced traders.

Algorithmic trading: Merging man and machine for precision

The rise of technology has paved the way for algorithmic trading to become an essential tool for advanced UK traders. Algorithmic trading, often referred to as algo trading, involves using pre-programmed rules to automatically execute trades. This strategy leverages the speed and precision of machines to capitalize on market inefficiencies or execute complex strategies.

While algorithmic trading might seem complex, it offers UK traders a way to implement their strategies with high accuracy and discipline. Traders can develop algorithms that analyze multiple factors simultaneously, ensuring trades are executed without emotional biases.

However, it’s important to note that developing practical algorithms requires a deep understanding of programming, data analysis, and market structure.

Options strategies for enhanced futures trading 2.0

In futures trading 2.0, advanced UK traders increasingly incorporate options strategies to enhance their approach. Options provide a unique set of opportunities that can complement traditional futures trading techniques.

Straddle and strangle strategies, for instance, allow traders to capitalize on volatility regardless of market direction. By simultaneously buying both a call and a put option with the same strike price and expiration date (straddle) or buying out-of-the-money call and put options (strangle), traders can profit from significant price movements while limiting potential losses.

Options strategies enable UK traders to express more nuanced views on market trends. The butterfly spread, for instance, involves using a combination of options contracts with three different strike prices to profit from minimal price movements near a specific target price.

This strategy is ideal for situations where a trader expects moderate price fluctuations and can prove profitable even if the asset’s price doesn’t experience drastic changes.

Also Check: Trading Myths Every New Trader Should be Careful

Conclusion:

As UK traders navigate the world of futures trading 2.0, they recognize the value of unconventional strategies beyond traditional approaches. Macro trends, pairs trading, volatility skew analysis, and algorithmic trading present opportunities for those willing to delve into uncharted territories.

The evolving landscape of financial markets demands a blend of strategic thinking, technological prowess, and a commitment to continuous learning.

By embracing these uncommon strategies, UK traders can position themselves for success in the ever-changing world of futures trading, where innovation and adaptability are crucial to staying ahead of the curve.