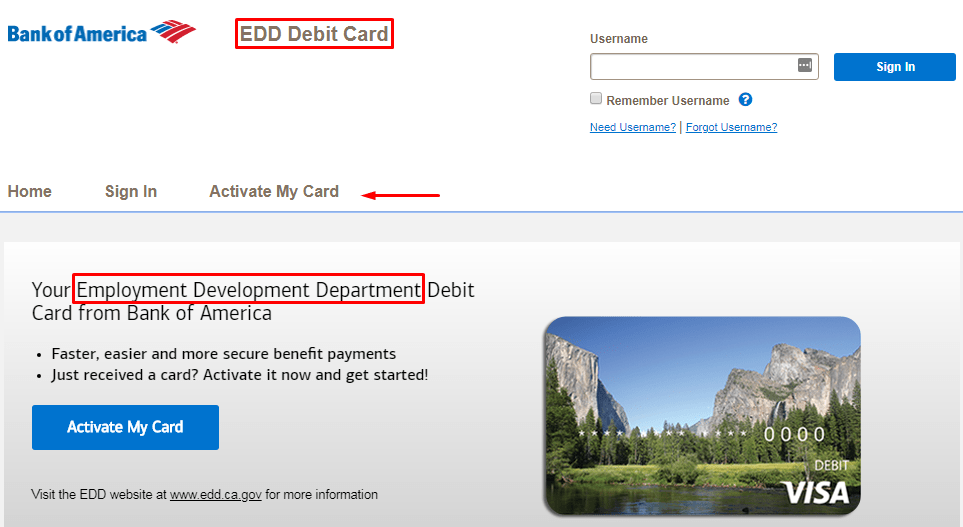

How to Get Insurance to Pay for Nose Job – If you’re considering getting a nose job and want to know if your insurance will cover it, the first thing you should do is check with your insurance provider. Insurance policies vary, so the best way to know for sure if your insurance will cover a nose job is to contact them directly and ask about their specific coverage for plastic surgery procedures.

If your insurance does cover a nose job, they will likely require that the procedure be deemed medically necessary. This means that the procedure must be performed by a licensed medical professional for a specific medical reason, such as to improve your breathing or correct a deformity.

If your insurance doesn’t cover a nose job, there may be other options available to help you pay for the procedure. Some plastic surgeons offer financing plans, and you may be able to use a credit card or take out a personal loan to help cover the cost. It’s also worth considering setting aside money in a dedicated savings account to help pay for the procedure.

How to Get Insurance to Pay for Nose Job?

In general, it’s important to carefully consider the cost and potential risks of any plastic surgery procedure before deciding to move forward. It’s a good idea to consult with a qualified plastic surgeon and discuss your options in detail before making a decision.

How to Arrange Money for Medical Expenses?

If you’re facing medical expenses and need help arranging the necessary funds, there are several potential options to consider. Here are a few steps you can take to help cover the cost of medical care:

- Check with your insurance provider to see what is covered under your policy. Many insurance plans will cover at least some of the cost of medical care, so it’s important to understand your benefits and what you may be required to pay out of pocket.

- Explore financial assistance programs. Many hospitals and other medical facilities offer financial assistance programs for patients who are unable to pay for their medical care. These programs may offer reduced or discounted rates, payment plans, or other forms of financial assistance.

- Consider crowdfunding. Crowdfunding platforms, such as GoFundMe, allow you to create a campaign to raise money for specific expenses, such as medical bills. You can share your campaign with friends and family, and anyone who is able to contribute can make a donation to help cover your expenses.

- Look into personal loans. If you have good credit, you may be able to take out a personal loan to help cover your medical expenses. Personal loans typically have lower interest rates than credit cards, and they can provide a fixed amount of money that you can use to pay your medical bills.

- Consider using a medical credit card. Medical credit cards are specifically designed to help cover the cost of medical expenses. These cards often offer low or 0% interest rates for a limited time, and you can use them to pay for your medical bills. However, it’s important to carefully read the terms and conditions of these cards to understand the interest rates and fees that may apply.

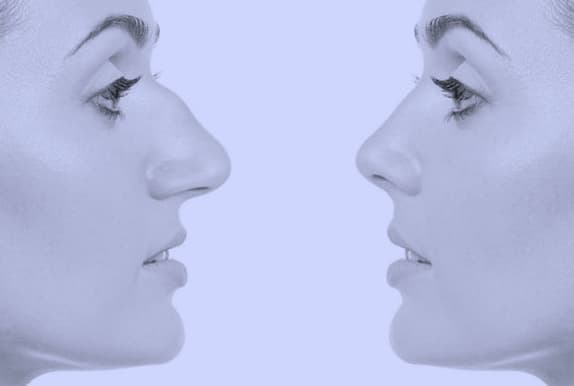

Does Health Insurance Cover a Nose Job?

Whether or not a nose job (also known as rhinoplasty) is covered by health insurance depends on the specific details of your policy and the reason for the procedure. In general, health insurance will cover a nose job if it is deemed medically necessary.

A nose job is considered medically necessary if it is performed by a licensed medical professional to improve your breathing, correct a deformity, or address a medical condition that affects your ability to function normally. Examples of conditions that may be treated with a medically necessary nose job include a deviated septum, nasal obstruction, or a genetic deformity.

If your nose job is considered medically necessary, your health insurance provider will likely cover at least some of the cost. However, you will likely be required to pay a portion of the cost out of pocket, and your policy may have limits on how much it will cover.

If your nose job is purely cosmetic and not medically necessary, it is unlikely that your health insurance will cover it. In this case, you will need to pay for the procedure out of pocket. Some plastic surgeons offer financing plans or other options to help you pay for a cosmetic nose job, so it’s worth discussing these options with your surgeon.

Things to Remember Before Taking Health Insurance

If you’re considering taking out a health insurance policy, there are a few important things to remember before making a decision. Here are a few key things to keep in mind:

- Understand your needs. The first step in choosing a health insurance policy is to assess your own healthcare needs. Consider factors such as your current health, any pre-existing conditions, your age and gender, and your budget. This will help you determine the type of policy that will best suit your needs.

- Compare policies from different providers. Once you know what type of policy you need, it’s important to compare policies from different providers to find the one that offers the best coverage at the most affordable price. This can be a time-consuming process, but it’s worth it to make sure you’re getting the best policy for your needs.

- Read the fine print. Before signing up for a policy, it’s essential to carefully read the terms and conditions to understand exactly what is covered and what is not. Pay particular attention to any exclusions or limitations, and make sure you understand the policy’s deductible and co-payments.

- Consider additional coverage. In addition to a basic health insurance policy, you may also want to consider additional coverage options, such as dental, vision, or prescription drug coverage. These types of policies can help you cover the cost of additional healthcare expenses that are not included in your basic policy.

- Review your policy regularly. Healthcare needs and costs can change over time, so it’s important to review your policy regularly to make sure it still meets your needs. Consider factors such as changes in your health, your age, your family situation, and your budget when reviewing your policy.

Also Learn:

Conclusion:

So now you have an informative guide on How to Get Insurance to Pay for Nose Job and if you still have any queries or feedback then you can drop your queries in the comment section below.